In the coming year, Punjab will become the first province to have a provincial budget that crossed the trillion-rupee line, with Finance Minister Shujaur Rahman announcing a Rs1.2 trillion budget for fiscal year 2014 on Monday, focused as in previous years on enhancing the province’s core economic strengths in agriculture and infrastructure.

The budget has several common themes carried over from previous years’ budgets as the infrastructure-friendly ruling Pakistan Muslim League Nawaz (PML-N) seeks to build roads, highways, power plants, and irrigation canals in the province. The development budget has been set at Rs290 billion, about 74% higher than last year’s spending numbers, though only about 16% higher than the development budget announced last June. Punjab, like Sindh, has a problem with being able to spend all of the money it allocates, largely owing to the inefficiency of the provincial bureaucracy.

In contrast to the federal budget announced by the PML-N, the provincial budget contained far more populist measures:

there was an increase in the provincial minimum wage from Rs9,000 to Rs10,000 and the government announced several new taxes on the more affluent segments of society.

Taxation and austerity

Given the fact that a large proportion of most wealthy Pakistanis’ net worth is tied up in residential real estate, the provincial government has decided to levy a tax on it.

Residential properties of between two and four kanals (1,210 square yards to 2,420 square yards) will have to pay an annual tax of Rs500,000. Properties of between four kanals and an acre (4,840 square yards) will be required to pay Rs1 million in taxes and residential properties larger than one acre will be required to pay Rs1.5 million in taxes.

Analysts suggest that the vast majority of residential real estate in the province will not be affected by the tax, which appears to be the government’s goal anyway. “Our taxation plans target the rich,” said Punjab Chief Minister Shahbaz Sharif.

The finance minister had similar sentiments. “The Punjab government will not levy any tax on the poor. Only those segments will be brought into the tax-net which can pay taxes,” said Shujaur Rehman.

The provincial government also pledged to implement the Punjab Agricultural Income Tax Act of 1997, though they did not specify how this would be done.

Spending priorities

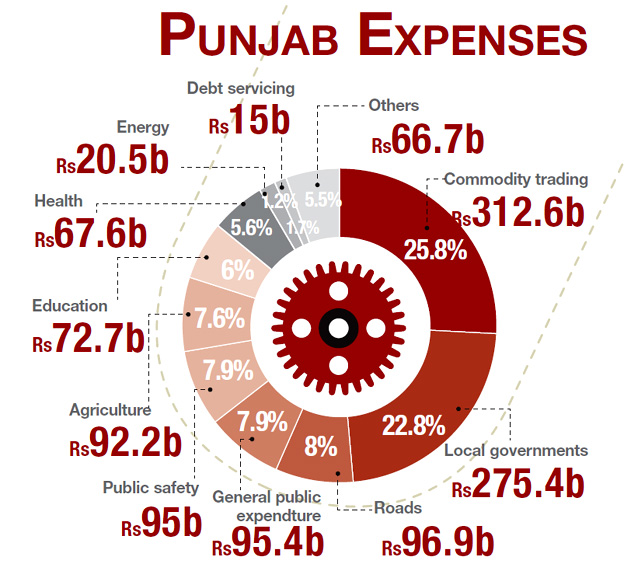

In addition to several populist schemes – including a continuation of the students laptops scheme – the provincial government appears to have largely decided to stick to the formula that worked in their previous term, with only one major exception: the allocation for development projects in the energy sector have been doubled, albeit only to Rs20 billion.

Aside from the massive wheat-buying operation of the provincial government – which is financed through bank borrowing and not taxes – the single biggest expenditure of the Punjab government will be the salaries of local government employees, mostly school teachers and medical professionals working in public health facilities.

The next largest expenditure is on roads and other physical infrastructure, clocking in at Rs97 billion, an increase of over 26% from last year. And in a bid to address the allegation that Lahore monopolises the provincial budget, about Rs10 billion has been earmarked to bring Faisalabad, Multan, Rawalpindi and Gujranwala at par with provincial metropolis.

The provincial government will continue its land record computerisation programme, as a means of trying to secure property rights in a province that is already known to have a relatively stable rule of law. Public safety expenditure in the province is expected to come to about Rs95 billion, up by nearly 12% compared to last year.

The chief minister’s favourite laptop scheme for college students, meanwhile, is expected to cost Rs1 billion. About Rs7.5 billion will be spent trying to run agricultural tube-wells on biogas and solar energy. Another Rs22.5 billion will be spent improving the province’s irrigation system.

Published in The Express Tribune, June 18th, 2013.